All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money worth of an IUL are normally tax-free up to the quantity of premiums paid. Any type of withdrawals over this quantity may be subject to taxes depending on plan framework.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for a minimum of 5 years and the individual mores than 59. Properties withdrawn from a traditional or Roth 401(k) prior to age 59 might incur a 10% penalty. Not specifically The insurance claims that IULs can be your own financial institution are an oversimplification and can be deceiving for several factors.

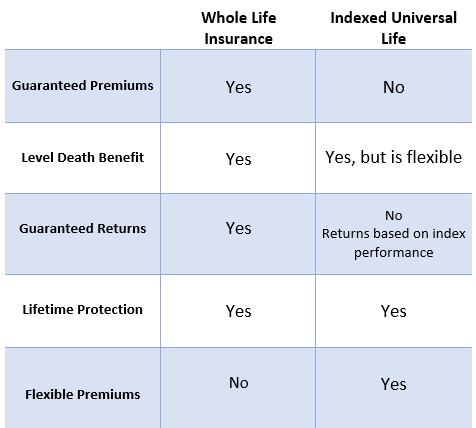

However, you may go through upgrading linked health and wellness inquiries that can impact your recurring costs. With a 401(k), the cash is always your own, including vested employer matching despite whether you stop adding. Danger and Guarantees: Firstly, IUL plans, and the cash worth, are not FDIC insured like common financial institution accounts.

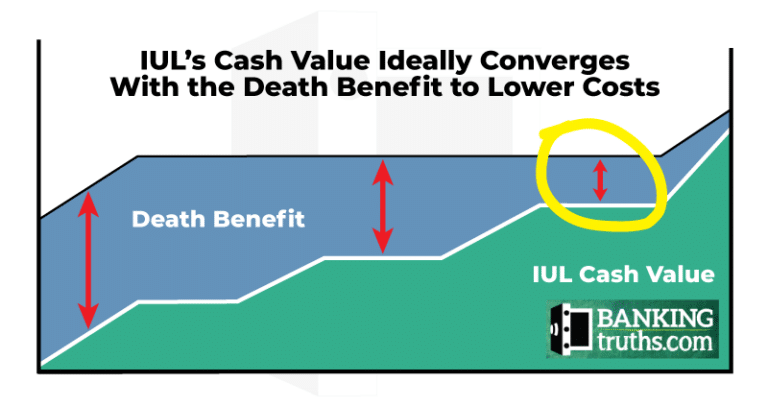

While there is usually a flooring to stop losses, the growth possibility is topped (suggesting you may not fully take advantage of market increases). Many specialists will agree that these are not comparable products. If you desire survivor benefit for your survivor and are worried your retirement cost savings will not suffice, then you might want to take into consideration an IUL or other life insurance product.

Certain, the IUL can provide access to a cash account, but again this is not the main function of the product. Whether you desire or need an IUL is a very individual question and depends on your main economic objective and objectives. Nonetheless, listed below we will attempt to cover benefits and limitations for an IUL and a 401(k), so you can better mark these items and make a more informed decision relating to the ideal way to take care of retirement and caring for your liked ones after death.

Minnesota Life Eclipse Iul

Lending Costs: Financings against the plan accrue interest and, if not settled, lower the fatality advantage that is paid to the recipient. Market Participation Limits: For the majority of plans, investment growth is tied to a stock market index, however gains are normally topped, restricting upside possible - variable universal life vs indexed universal life. Sales Practices: These policies are commonly sold by insurance policy representatives who might emphasize advantages without completely clarifying expenses and dangers

While some social media experts recommend an IUL is an alternative product for a 401(k), it is not. Indexed Universal Life (IUL) is a kind of long-term life insurance plan that additionally offers a cash value element.

Latest Posts

Universal Life Insurance

Whole Life Insurance Vs Indexed Universal Life

Index Universal Life Insurance Nationwide